LOGISTEED

We will accelerate LOGISTEED under a new partnership and aim to become a "leading global 3PL company."

Yasuo Nakatani

Chairman and CEO

Review of the Mid-term Management Plan "LOGISTEED2021"

Posted record high revenues and operating income*1, achieving the targets set in the Mid-term Management Plan

Under the Mid-term Management Plan "LOGISTEED2021" which started in FY2019, aiming to become the most preferred global supply chain solutions provider, we worked on six priority measures of "Implement portfolio strategy, including M&As and alliances, to build a solid core domain (Smart Logistics)," "Implement collaborative innovation strategy aiming at enhancement of the core domain and further expansion of domains," "Design supply chain based on and originating from logistics domain," "Implement a topline*2 growth strategy," "Originate and succeed operation (hands-on approach) toward the next generation," and "Environment, social and governance as well as corporate ethics," and were committed to changing and evolving into a company represented by "LOGISTEED*3."As a result, in FY2021, the final year of the Plan, we were able to post record high consolidated revenues and operating income*1, achieving the targets set in the Plan.

*1: Adjusted operating income-basis*2: Topline: Net sales (revenues) presented at the top of the statement of profit or loss.*3: LOGISTEED: A word that combines LOGISTICS with Exceed, Proceed, Succeed, and Speed. It represents our determination to lead businesses to a new domain beyond the conventional logistics.

Issues in the Development of Overseas Business

Looking at each measure, as for "Implement portfolio strategy, including M&As and alliances, to build a solid core domain (Smart Logistics)," we transferred shares of Hitachi Auto Service Co., Ltd. and Hitachi Travel Bureau Ltd. (currently, HTB-BCD Travel Ltd.), but we added new sources of value creation through acquisition of shares of PALENET CO., LTD. and the distribution service business of Hitachi Life, Ltd. (currently, Hitachi Real Estate Partners, Ltd.), achieving some progress in the enhancement of core domain. The portfolio strategy in global logistics lost momentum partly due to the impact of COVID-19 despite a share exchange between Nisshin Transportation Co., Ltd. and AIT Corporation. I recognize this as the biggest issue that was carried over to the new Mid-term Management Plan. Regarding "Implement collaborative innovation strategy aiming at enhancement of the core domain and further expansion of domains," although there was a partial amendment to the capital relationship with SG Holdings Group, collaborative innovation activities including sales tie-up and resource sharing made solid contribution to revenues, and we were also able to deepen mutual understanding and communication between two companies at each level, from top management to sites, so we will continue working on this initiative.As for "Design supply chain based on and originating from logistics domain," we made significant progress as we started external sales of DX solutions such as SSCV*4 (transport digital platform) and SCDOS*5 (Supply Chain Design & Optimization Services) and also acquired a patent for RCS*6. As for "Originate and succeed operation (hands-on approach) toward the next generation," we continued to work mainly on VC activities*7 through online communication amid the COVID-19 pandemic and addressed DX and other various themes, producing steady achievements.And for "Environment, social, governance and corporate ethics," we developed and revised the medium-to-long-term environmental targets 2030/2050 and started initiatives to achieve net zero carbon by 2050, announced our endorsement of TCFD*8 recommendations and received "A-" in the CDP*9 Climate Change Report 2021 for two consecutive years.

*4 SSCV: Smart & Safety Connected Vehicle*5 SCDOS: Supply Chain Design & Optimization Services*6 RCS: Stands for Resource Control System and refers to an integrated control system equipped with work execution function that gives instructions to each facility and worker based on the information on the operation status of the automated equipment and the work results of workers within the logistics center.*7 VC: Stands for Value Change & Creation and refers to daily improvement activities to implement the HB Way

*8 TCFD: Task Force on Climate-related Financial Disclosures*9 CDP: A non-profit organization in the U.K., which investigates, evaluates, and discloses information on "climate change" and other environmental matters of corporations upon request of investors in the world.

Recognition and Response to External Environment

Accelerate the "region-contained" overseas business in light of the fact that the world has become more VUCA*10 than ever and various risks are increasing

We recognize that the recent business environment has become increasingly more "VUCA" as represented by the infectious disease risk such as COVID-19 and rising geopolitical risks such as the U.S.-China feud and the recent Ukraine crisis. In fact, COVID-19 and the Ukraine crisis caused disruptions in global supply chains mainly in the manufacturing industry, and its impact on the logistics sector is becoming bigger and bigger. For example, in the fiscal year ended March 31, 2022, the Group's business for automobile-related customers showed relatively steady growth in the U.S. where region-contained supply chains are well established but the volume decreased in Asia due to production cut caused by the disruption in supply chains. Also, in the freight forwarding business operating across multiple regions, the sea and air freight costs which are rising and hovering at a high level are contributing to revenue growth of the Group at the moment but will weigh on our customers' business in the medium-to-long term and become a risk factor. In addition, because the sustainability/ESG initiatives on a global scale are prompting calls for respect for human rights in supply chains, the conventional global procurement networks giving top priority to cost efficiency must be reviewed.Based on these trends, I think it is likely that the global supply chain in the future will be simplified and restructured toward the direction of "local production for local consumption". The Group has developed most of its overseas business through collaborative innovation with local partners under the "region-contained business model" whereby local subsidiaries operate businesses at their discretion and we focus on the supervision. We will further promote this model and also accelerate new business development in North America, Europe, India, Thailand, and Malaysia., etc.

*10 VUCA: Volatility, Uncertainty, Complexity, and Ambiguity

Take advantage of changes in industrial structure due to the expansion of EC markets by further evolving DX

Another point in the business environment is a significant change in the industrial structure in Japan and overseas due to the expansion of EC markets. Major EC platformers are beginning to take over a number of functions which used to be undertaken by wholesalers and retailers such as procurement, shipping, sales, and service. As the logistics industry has become even more "borderless," which has been discussed in the Integrated Reports, the Group will continue to expand the initiatives to integrate four flows of "Finance," "Commerce," "Information," and "Logistics," one of the concepts under "LOGISTEED," to take advantage of this change.Specifically, we will evolve automation in 3PL, our core business, using WMS*11 and RCS*12, optimize the entire supply chain through visualization, and focus on further enhancement of the system development infrastructure to promote external sales of IT systems enhanced by these DX.

*11 WMS: Stands for Warehouse Management System*12 RCS: Resource Control System

Recognize "labor shortages" as "constant facts" and evolve "automation" and "sharing"

We recognize "labor shortages" deeply related to the expansion of EC markets and the "2024 problem*13" in Japan as "constant facts," rather than changes, and continue to implement measures while evolving existing initiatives.Specifically, in addition to evolving various automation mentioned above, we will share resources, including human capital, with peer companies and stakeholders in other sectors and also apply the results of these efforts implemented in Japan as a "country facing many social issues" such as declining birthrate and aging population to Asian countries which are expected to face the same issue.

*13 2024 problem: Concerns about issues that might arise from the upper limit of drivers' working hours, etc. set by the work style reform-related bills

Consider medium-to-long-term measures against "2030 issue" in decarbonization

As mentioned above, the Group strives to reduce CO2 emissions by average 2.94% annually and aims to reduce CO2 emissions in FY2030 by 50% compared to the FY2013 level under the medium-to-long-term environmental targets 2030/2050.We plan to make a total of ¥5 billion of investment in "energy saving," "electrification," "procurement of renewable energy," "energy creation," and "emissions trading" during the period covered by the Plan. In addition to aggressively promoting shifts to electric trucks and to renewable energy in offices and logistics centers, we will consider medium-to-long-term measures such as "energy creation" by installing solar panel at logistics centers.

Revision to Material Issues

Identified new material issues incorporating the business perspective prior to the development of the new Mid-term Management Plan

Based on the recognition of the business environment described above, the Group will continue to focus on further business growth and enhancement of corporate value under the corporate philosophy and corporate vision. Before developing the new Mid-term Management Plan to achieve that goal, we reviewed material issues to re-recognize social and environmental issues we must address and social responsibilities we must fulfill. We incorporated the business perspective in addition to the ESG perspective to the new material issues and, based on DX, will work on 12 material issues linked to three objectives of "contribute to decarbonized/ recycling-oriented society," "build and evolve resilient, sustainable logistics services," and "create new values through collaborative innovation" and supportive foundation for the objectives. And we developed the new Mid-term Management Plan "LOGISTEED2024" in consideration of the achievements under the previous Mid-term Management Plan "LOGISTEED2021" and the new material issues with an aim to further solidify business and develop global business.

Mid-term Management Plan "LOGISTEED2024"

Promote four priority measures to become a "leading 3PL company in Asia"

Under the new Mid-term Management Plan "LOGISTEED2024" which started from FY2022, we will promote four priority measures consisting of "reinforce/ expand overseas business," "expand business domains with new added value," "evolve Smart Logistics," and "solidify ESG management base" under the slogan of "becoming a global supply chain strategic partner with DX, LT*14 and 'Gemba' Power," with an aim to become a "leading 3PL company in Asia."Specifically, to "reinforce/expand overseas business," we aim to become a "leading 3PL company in Asia" by expanding in-plant logistics at customers' factories in North America, expanding regional 3PL business in Europe, accelerating introduction of automated/laborsaving facilities in China and expanding investments/ businesses in growing markets including India, Thailand, Indonesia, and Malaysia, under the "region-contained business model" mentioned above. To "expand business domains with new added value," we will offer VAS*15 in logistics related domains, including boundary domain between manufacturing and logistics, of customers' value chain, such as solving customers' supply chain issues through DX and optimizing the entire supply chain by directly connecting procurement, manufacturing, and logistics.To "evolve Smart Logistics," we will enhance warehouse business through automation/labor-saving and DX and enhance and expand warehouse functions by building and enhancing three-temperature zone warehouses*16 and hazardous substances warehouses. In addition, we will enhance transport business to cope with the "2024 problem" mentioned above by implementing both physical and digital measures.To "solidify ESG management base," we will work on decarbonization as part of our efforts to address the new material issues mentioned above to achieve the medium-to-long-term environmental targets, and also realize centralized control for fire prevention and security at logistics centers through "safety cockpit" using AI and sensing technologies. To reinforce human capital to carry out priority measures in the new Mid-term Management Plan, we will increase and develop global and DX human resources to accelerate LOGISTEED.

*14 LT: Logistics Technology*15 VAS: Value-Added Services*16 Three-temperature zone warehouses: Storage facilities with ambient, chilled, and frozen warehousing

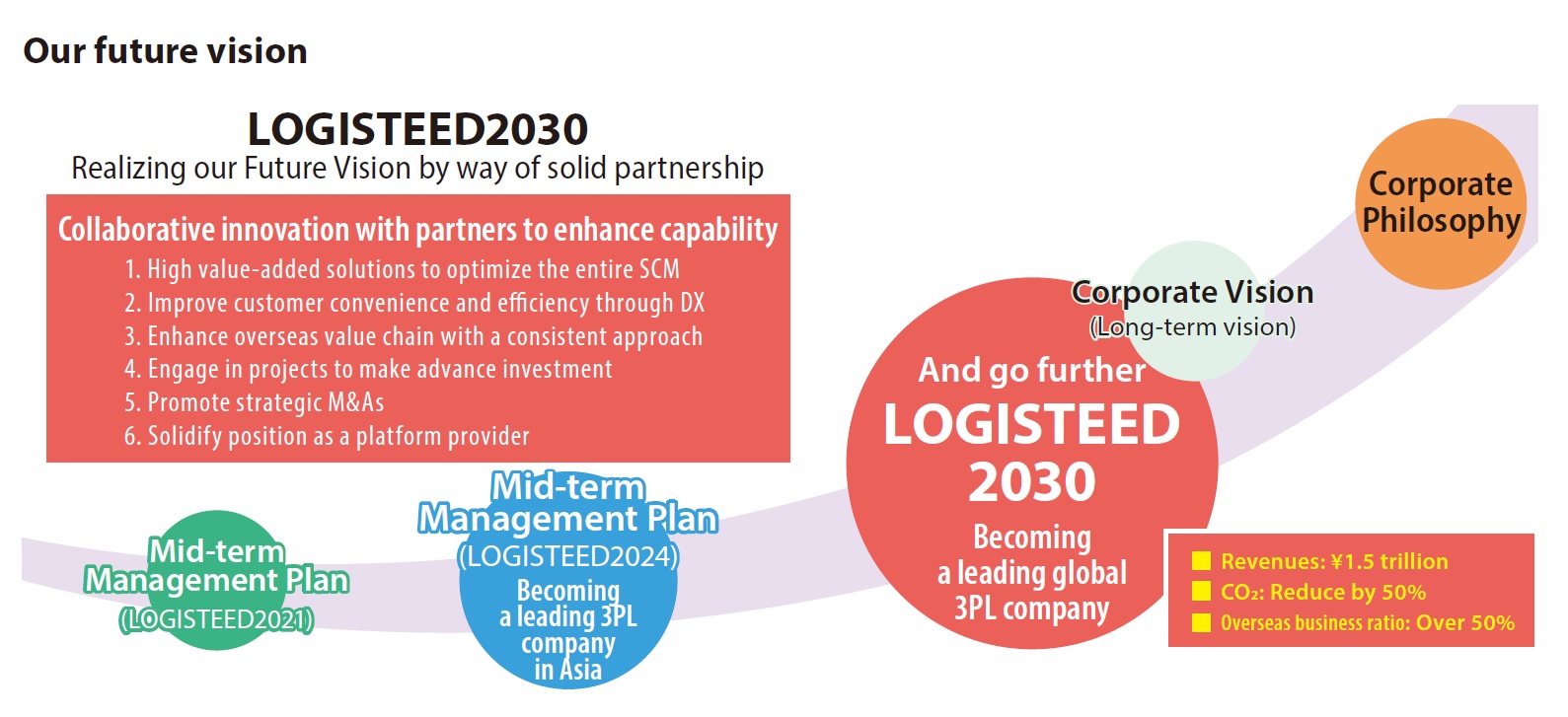

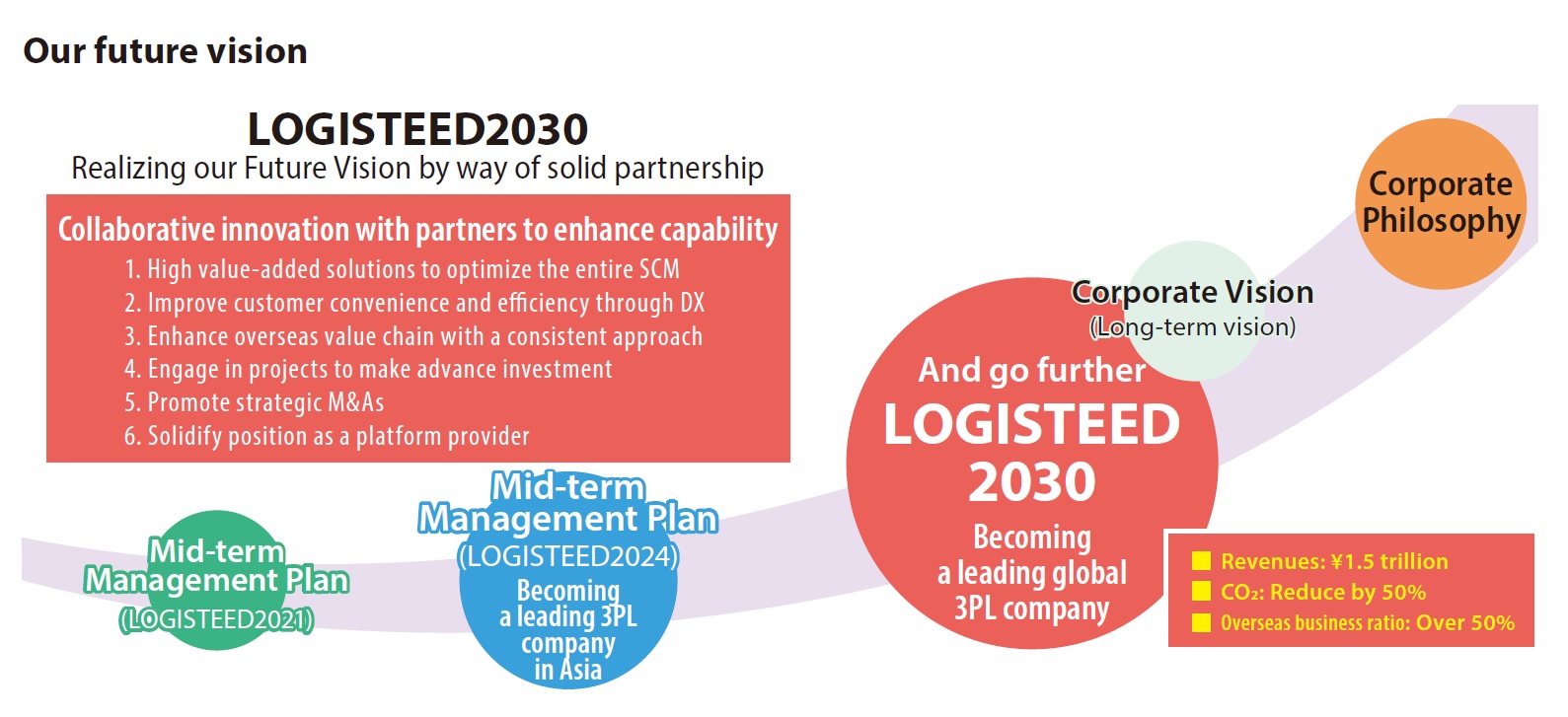

Medium-to-Long-term Vision "LOGISTEED2030"

Aim to become a leading global 3PL company

When we developed the Mid-term Management Plan "LOGISTEED2024," we also indicated our medium-to-long-term "Vision" beyond 2024 in "LOGISTEED2030."Under "LOGISTEED2030," we aim to achieve consolidated revenues of ¥1.5 trillion and overseas ratio of over 50% and also to reduce CO2 emissions by 50% as mentioned above. In addition, as we strive for these targets, we will also work on management issues shown below such as "High value-added solutions to optimize the entire supply chain management (SCM)," "Improve customer convenience and efficiency through DX," "Enhance overseas value chain with a consistent approach," "Engage actively in projects making advance investment," "Promote strategic M&As" and "Solidify position as a platform provider" through solid partnership.The most important new partner for the Group to realize "LOGISTEED2024" and "LOGISTEED2030" is Kohlberg Kravis Roberts & Co. L.P., a U.S. investment advisory firm, ("KKR" collectively with its associates and funds)

New Partnership to Realize LOGISTEED

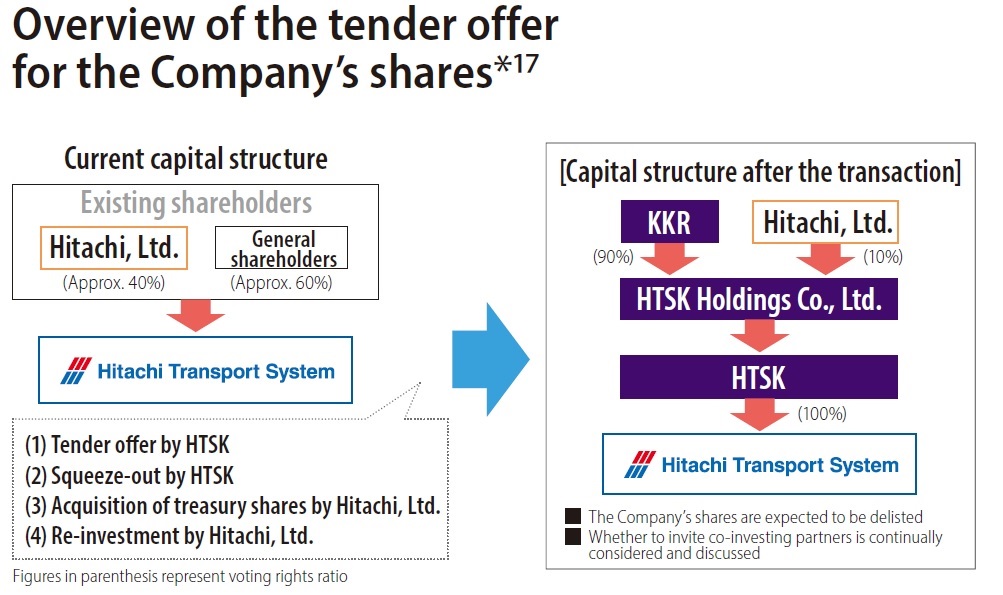

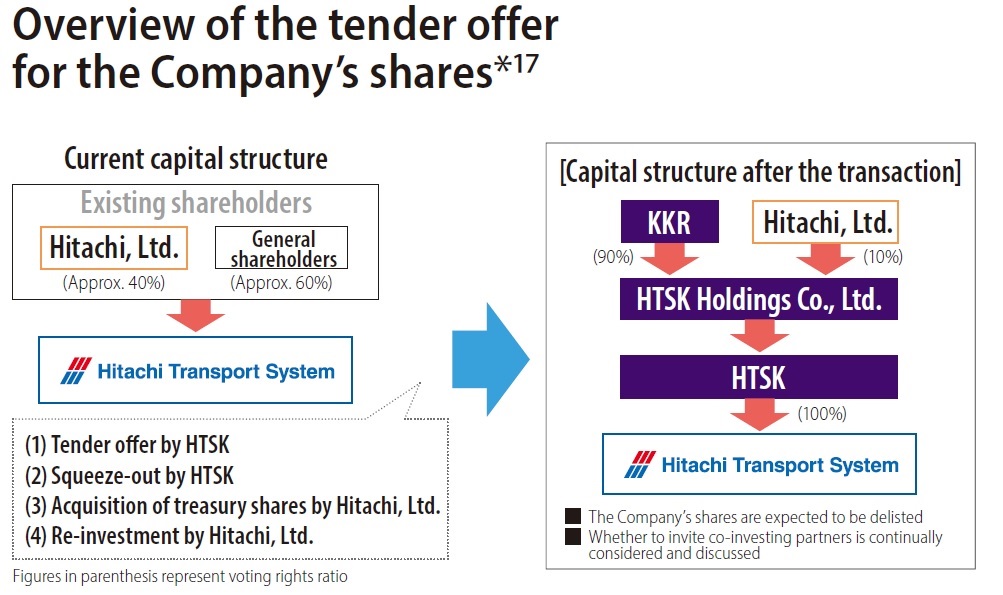

Move forward with reforms toward "Future Vision" with KKR

As indicated in the news release dated April 28, 2022 and in the chart below, the Group resolved at its Board of Directors' meeting held on that day to express an opinion supporting the tender offer made by HTSK Co., Ltd. for the Company's shares and recommend the Company's shareholders to tender their shares. This resolution was adopted on the assumption that the tender offeror intends to acquire all of the Company's shares and that the Company's shares will be delisted.The Group determined that, in order to promptly realize "Future Vision" of "LOGISTEED2030," it needs collaborative innovation with partners who supplement organizational capabilities to increase our competitiveness by, for example, speeding up decision making process, acquiring investment funds to enable flexible business investment and bringing in external insights, and it considered various options to promote prompt management and reforms that are not restricted by the current capital structure. We have had a series of discussions with multiple companies and investment funds about our growth strategy including potential capital transactions, and in particular, we have continually discussed with KKR over the last five years about the competitive advantages to accelerate business growth and achieve future growth, including potential M&As between the Company and business partners. As a result, we shared with KKR the direction toward the six management issues in "LOGISTEED2030" mentioned above, and we believe that we were able to build trust relationship as partners to increase corporate value in the future. Also, based on KKR's various support capabilities and remarkable past achievements, we determined that, to realize the Group's LOGISTEED, it would be best to delist our shares and promote reforms without being restricted by the current capital structure through a partnership with KKR who has an understanding of our business as well as insights, resources, strong commitment to the Japanese market and remarkable past achievements to support the enhancement of corporate value in the medium-to-long term.

*17 Please refer to "Announcement of Expression of Opinion in Support of the Scheduled Commencement of the Tender Offer by HTSK Co., Ltd. for the Shares of Hitachi Transport System, Ltd., and Recommendation of Tender" dated April 28, 2022 for details.

Aim to further grow our business and increase corporate value through exponential expansion of overseas business and DX promotion

As we operate under the corporate vision to become the "most preferred global supply chain solutions provider," the biggest business challenge for the Group is expansion of overseas business.Under "LOGISTEED2024," we will aim to become a "leading 3PL company in Asia" by focusing on expanding business in Asia. Under "LOGISTEED2030," we will change the direction with a strong will toward the achievement of consolidated revenues of ¥1.5 trillion and overseas ratio of over 50% as mentioned above. The Group has always worked on the development of human resources to support overseas business, but going forward, we will make the best use of KKR's experience and insights to exponentially expand overseas business. And we will aim to evolve into a "leading global 3PL company" by promoting DX in Japan and overseas and keep enhancing 3PL business, our identity.

To Our Stakeholders

Start the new structure with CEO and COO

To ensure to carry out the above-mentioned strategies and realize the concept "to lead businesses to a new domain beyond the conventional logistics," it is necessary to carry out a number of measures, including M&As, speedily and simultaneously. Accordingly, from April 2022, we started a new structure, with me as Chairman and CEO and Mr.Takagi as President and COO. Under the structure whereby CEO will be responsible for developing and finalizing management strategies including portfolio and capital strategies and monitoring of execution status, and COO will be focusing on execution of strategies and maintaining and expanding the existing business which are the base for sustainable growth, we will ensure to further grow our business and increase corporate value. We express our sincere apologies for causing a great deal of inconvenience and concern to our stakeholders because of the fire which occurred at a logistics center of our group company in November, 2021. We will devote our best efforts toward preventing any similar incidents from occurring by using DX such as "safety cockpit" mentioned above and establishing a resilient center that centrally controls safety, quality, productivity, fire prevention, and security through "visualization." The group will be an unlisted company but will sustainably create values by steadily executing "LOGISTEED2024/2030" through a strong partnership and financial base with KKR.We look forward to your continued support.